View a consolidated list of Institutional Owners and Holdings

Simplify 13F data

Institutional Owners and Holdings helps you find the institutional owners for a given company or what holdings institutional investment managers have disclosed.

The data comes from Form 13Fs, and while these forms provide insightful data on owners and their holdings, they are not formatted in a way to make it easy to find the information you need. By aggregating the data from 13F filings, Institutional Owners and Holdings enables you to easily gain insight on the latest institutional ownership and holdings without reviewing ownership filings one by one.

📘

Form 13F is a quarterly report that is required to be filed by all institutional investment managers with at least $100 million in assets under management. All equity securities (including options and some convertible securities) are required to be disclosed in this form.

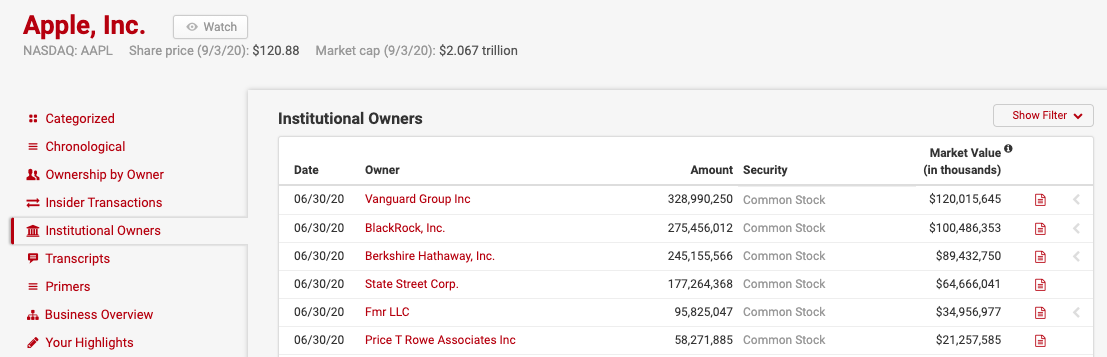

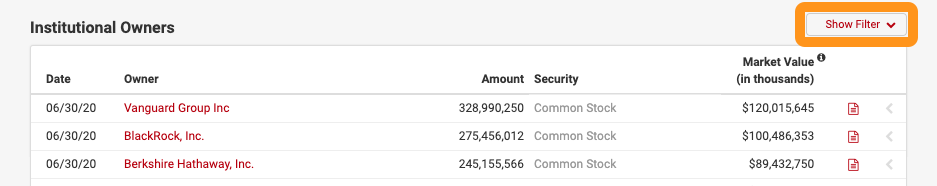

Institutional Owners

Institutional Owners are institutional investment managers that are required to file a 13F. This includes mutual funds, hedge funds, trust companies, pension funds, insurance companies, and registered investment advisors, all of which must have at least $100 million in equity assets under management.

Institutional Owners can be found on the left side of every company page and show the investment managers who have disclosed ownership for that company. Results are sorted by Market Value.

🚧

Please note that the Institutional Owners information is based directly on data in the 13F, so errors in the 13F itself may impact how data is presented or matched to the correct company where it has holdings.

🚧

Entities that are not institutional investment managers and investment managers with less than $100 million in assets under management are not required to file 13Fs, so the results in Institutional Owners may not reflect the complete set of investment manager owners of the company.

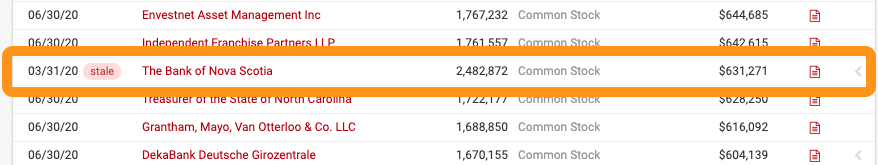

We display the most recent holdings data that have been filed. However, sometimes we will have holdings data from a 13F reflecting data from a prior quarter that has not been updated with a 13F for the most recent quarter. These are still shown in the results but are labeled stale.

Click the Show Filter button at the top right of the list to filter the results by owner name.

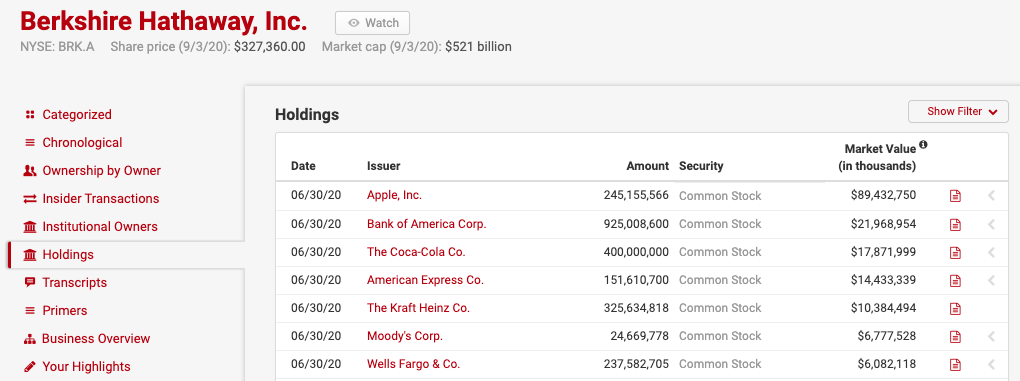

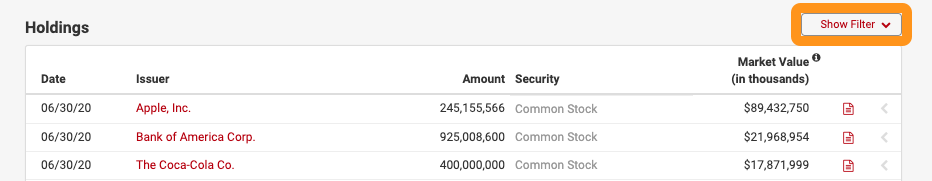

Holdings

Each Institutional Owner's list of holdings based on their latest 13F filing is available on their company page on BamSEC. Holdings include their long positions, put and call options, American Depositary Receipts (ADRs), and convertible notes as disclosed in their latest 13F.

Holdings can be found on the left side of company pages for 13F filers only. Results are sorted by Market Value.

Click the Show Filter button at the top right of the list to filter the results by issuer name.

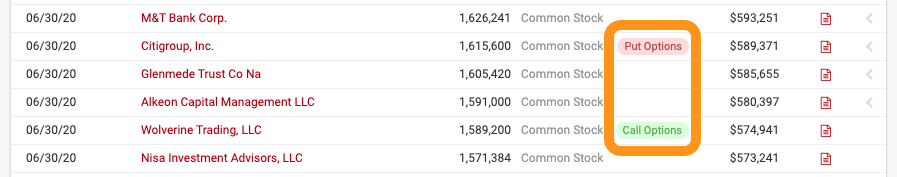

Call and Put Options

Call and Put Options are labeled with a tag next to the security name, as shown below. The SEC requires institutions to report the value of the underlying security which is displayed in the Market Value column. However, 13F filers may make mistakes in the filing (see Potential Issues with 13F Filings section below). We correct many of the common mistakes, but errors in the 13F may still impact these displayed values.

Convertible Debt

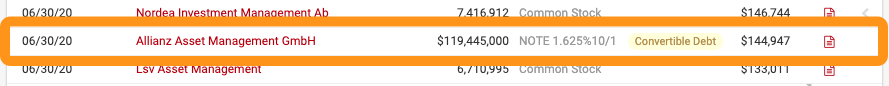

Convertible Debt is labeled as shown below. Please note that the value displayed in the Amount column for Convertible Debt reflects the principal amount borrowed.

Potential Issues With 13F Filings

The SEC has acknowledged that 13F filings may not be necessarily reliable since they are not verified for accuracy or completeness.

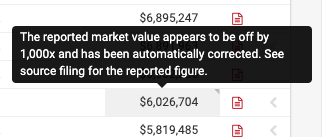

We will attempt to correct obvious errors in the Institutional Owners and Holdings results (e.g., Market Value incorrectly expressed in dollars instead of thousands of dollars). However, it is possible that there are still errors in reported holdings due to mistakes made by the filers of the 13F filing.

We will flag errors as shown below to indicate there was a potential issue with the filing.